Our Updated iPhone App

For those who missed yesterday’s post (Goldman Sachs: Time To Hedge?), a quick heads up: we launched an update of our iPhone hedging app this week, and it’s on sale this week for $4.99, down from its regular price of $84.99.

If you want to take advantage of that sale, you can download the app here, or by aiming your iPhone camera at the QR code below.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

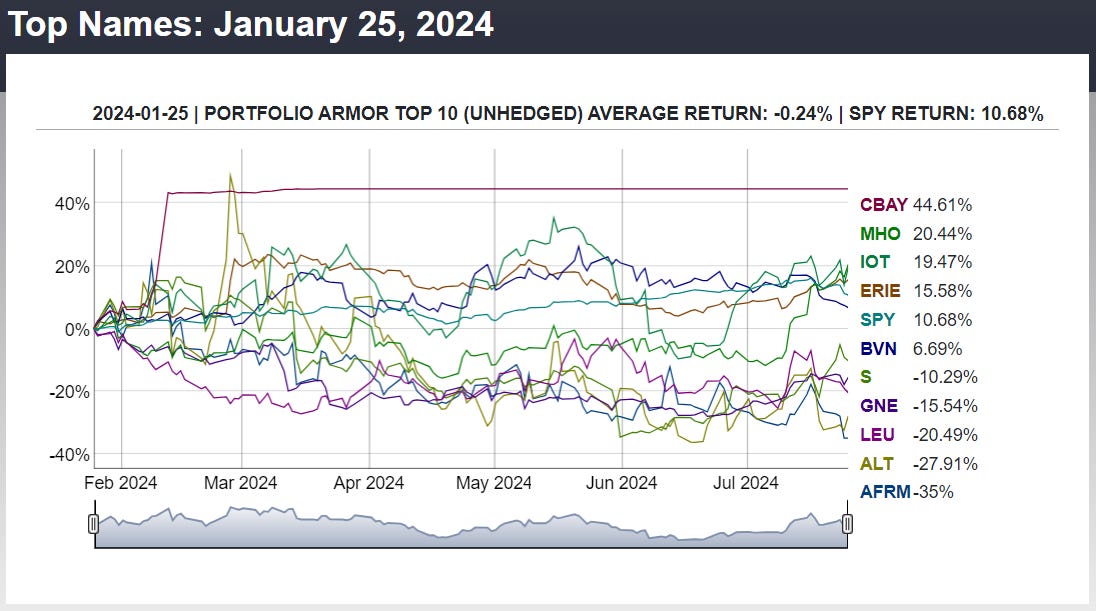

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from January 25th.

Over the next six months, our top ten names from January 25th were down 0.24%, on average, versus up 10.68% for the SPDR S&P 500 Trust (SPY 0.00%↑).

When you see a straight horizontal line in a chart, like the one for CymaBay Therapeutics (CBAY 0.00%↑) above, it means the company was acquired. In this case, CBAY was acquired by Gilead Sciences (GILD 0.00%↑) in March. When that happens, we track it as if you exited the stock when it was acquired and held that exit amount as cash for the rest of our tracking period.

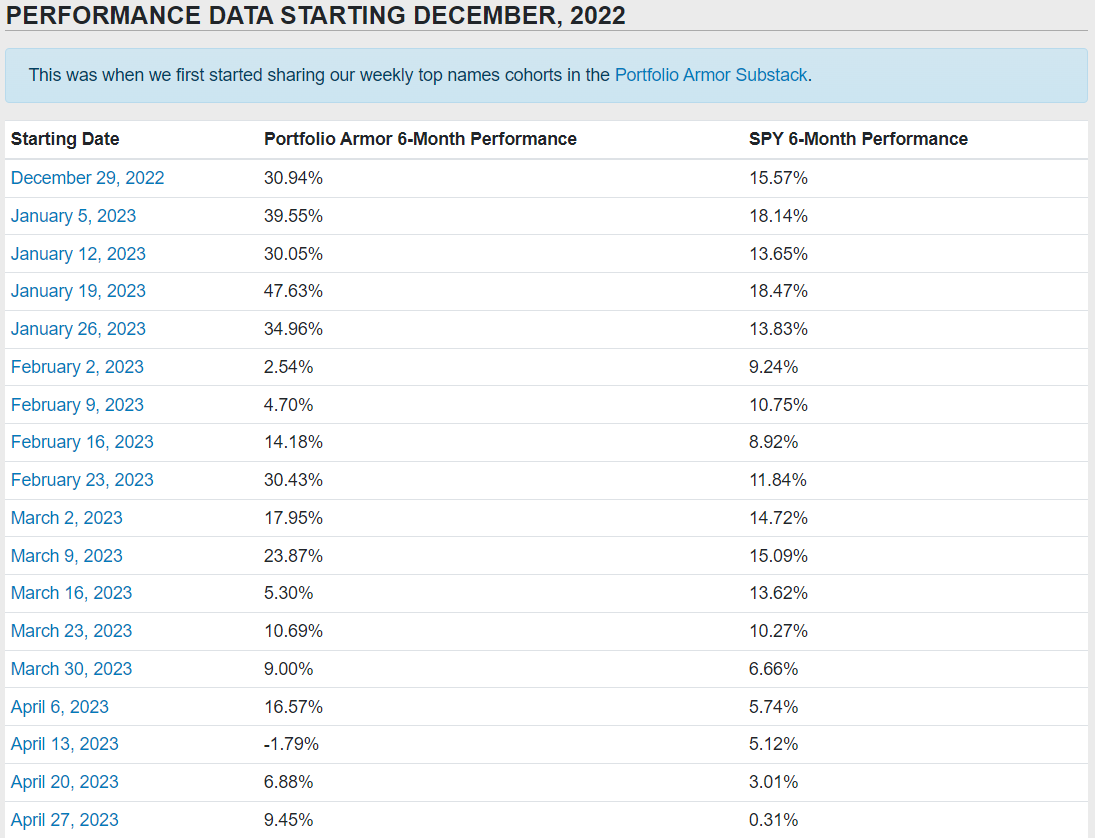

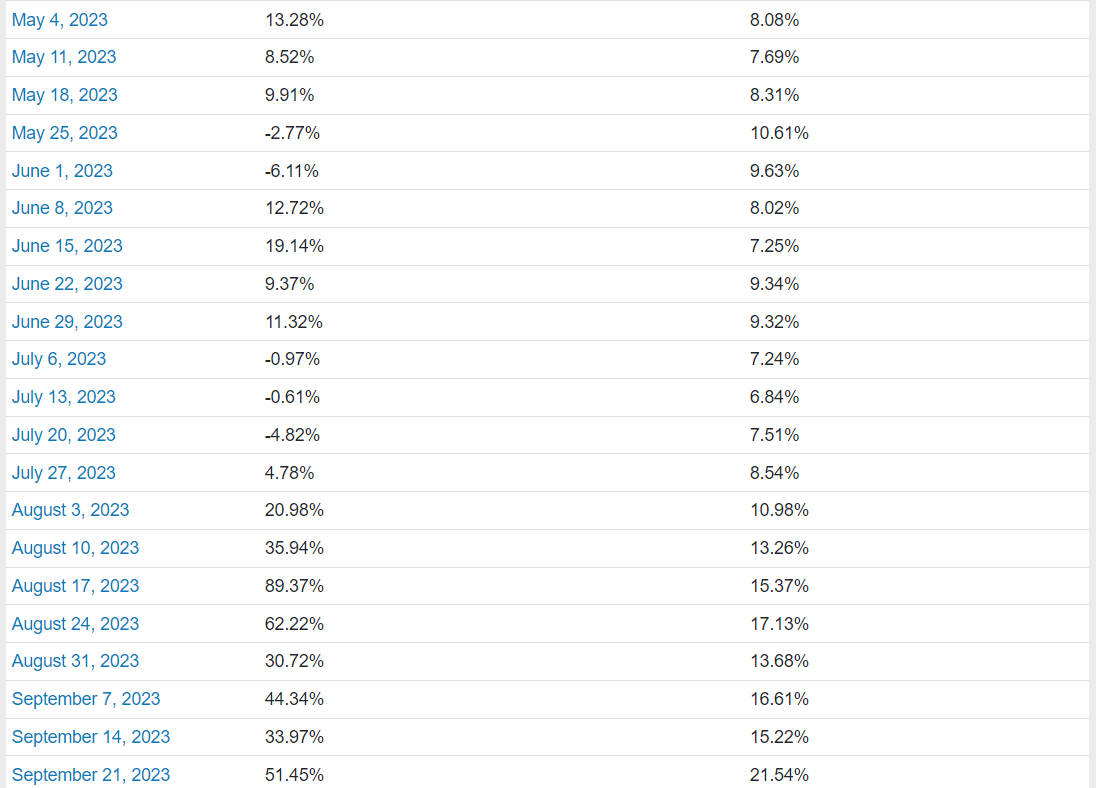

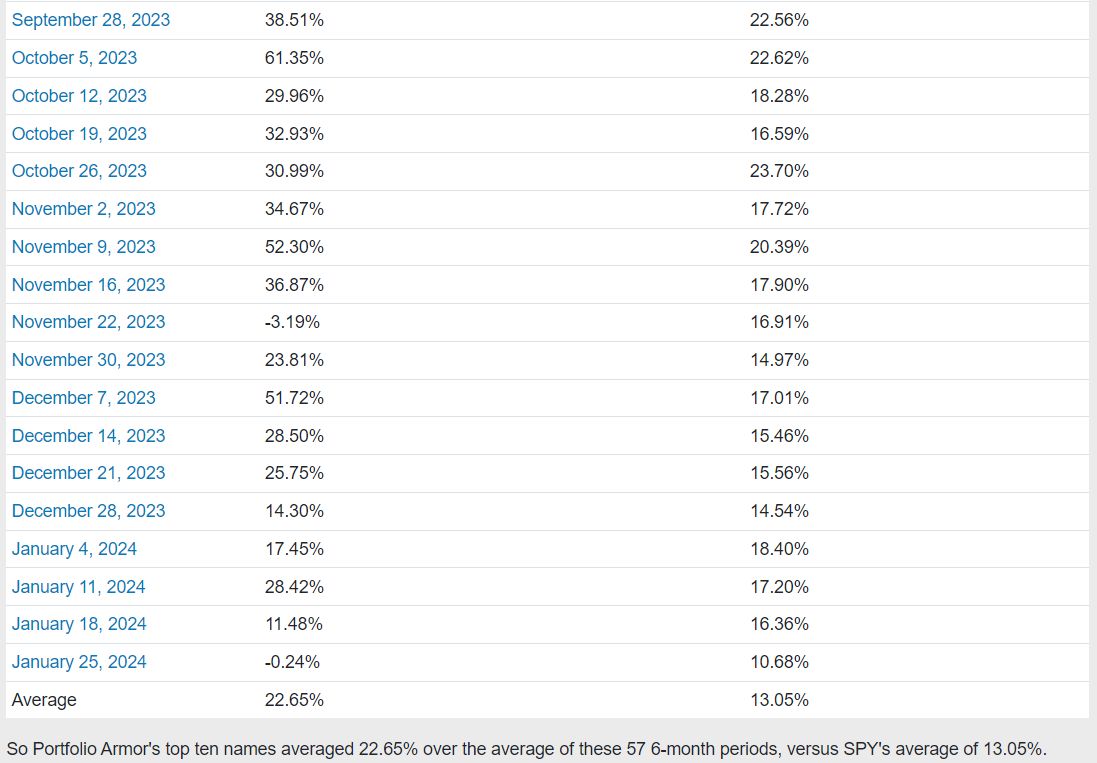

So far, we have 6-month returns for 57 weekly top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 22.65% over the next six months, versus SPY’s average of 13.05%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.