Top Names Performance Update

Our automated security selection system continues to outperform the market.

No Exits This Week

In our weekly Top Names posts, I usually show the performance of the top names cohort from six months earlier, but in Thursday’s Top Names post, we didn’t have the full, six-month performance of our December 7th top names cohort yet, so I wrote that I’d include that performance update in this week’s Exits post. As it happened, we didn’t have any trade exits this week, so I’m posting this as a stand-alone performance update.

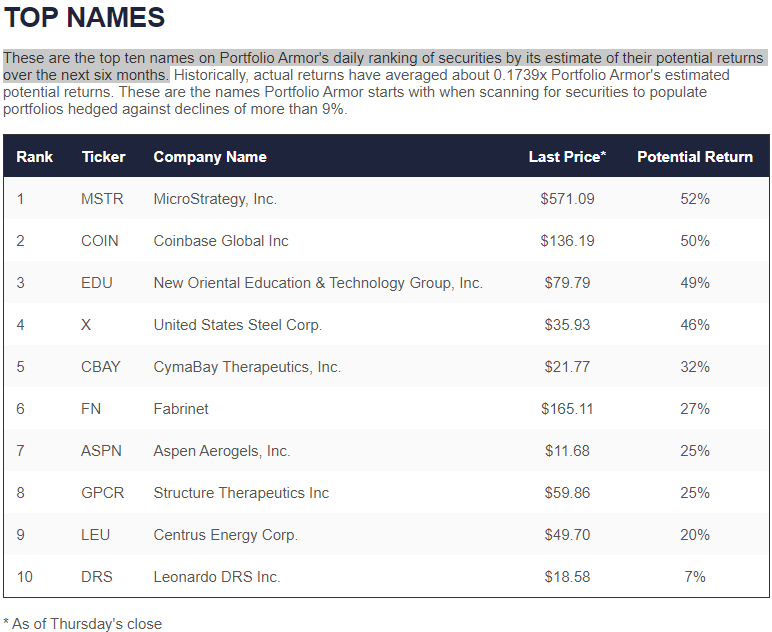

Our Top Ten Names From December 7th, 2023

These were our top ten names from December 7th, shared in this post at the time.

Screen capture via Portfolio Armor on 12/7/2023.

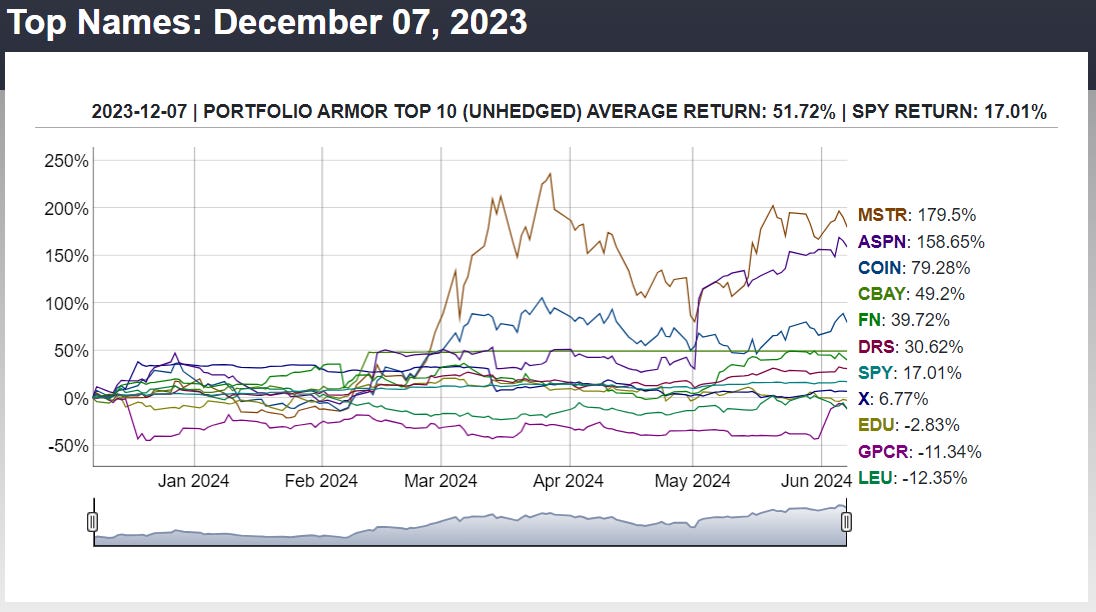

And here is how those top names performed over the next six months, versus the SPDR S&P 500 Trust (SPY 0.00%↑). They returned 51.72% versus SPY’s 17.01%.

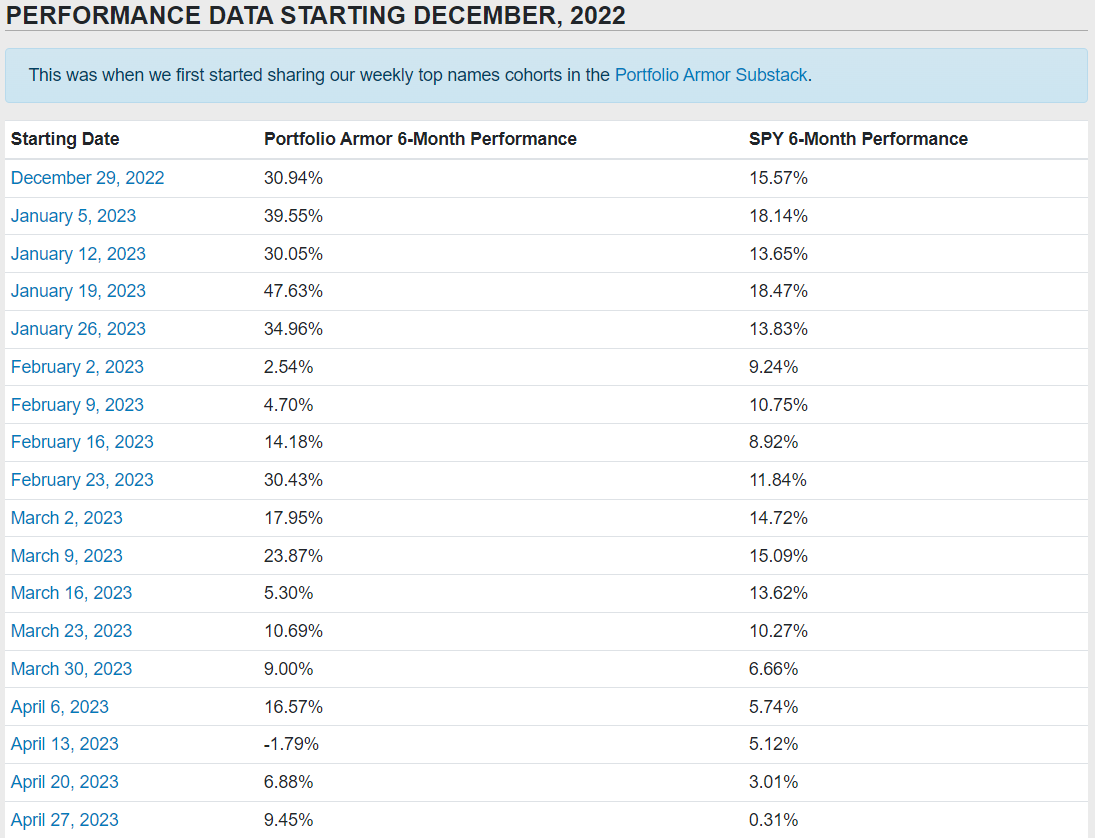

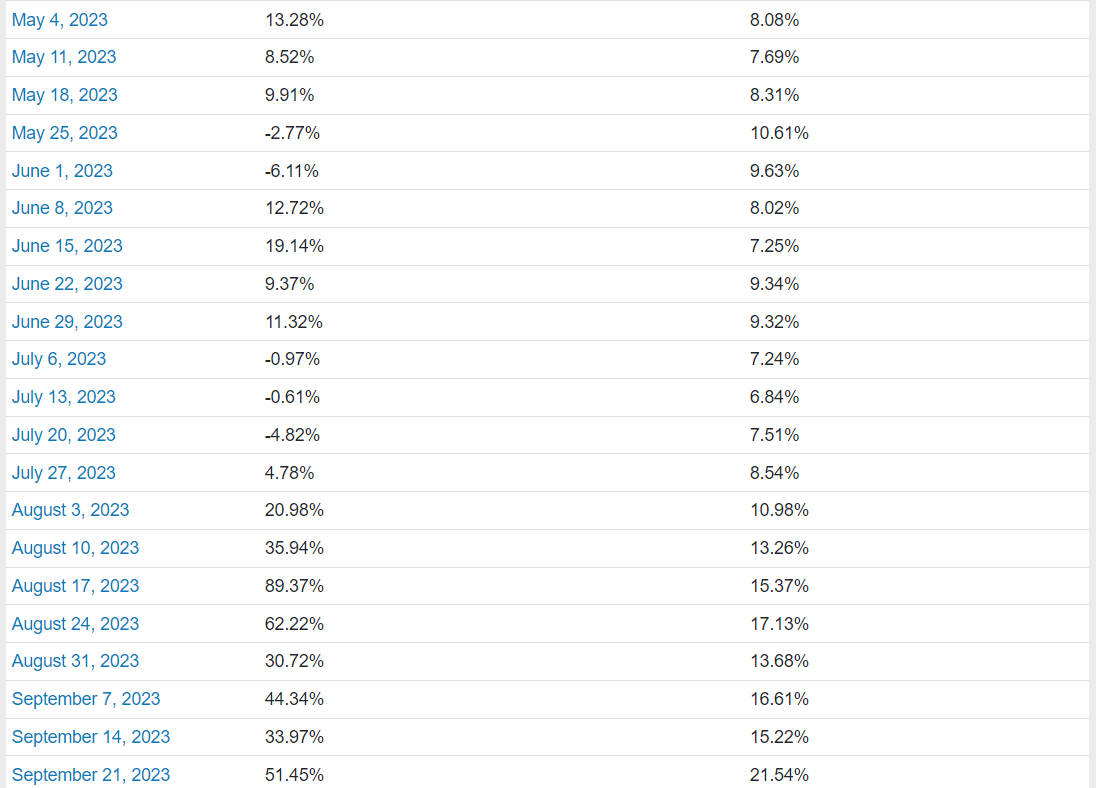

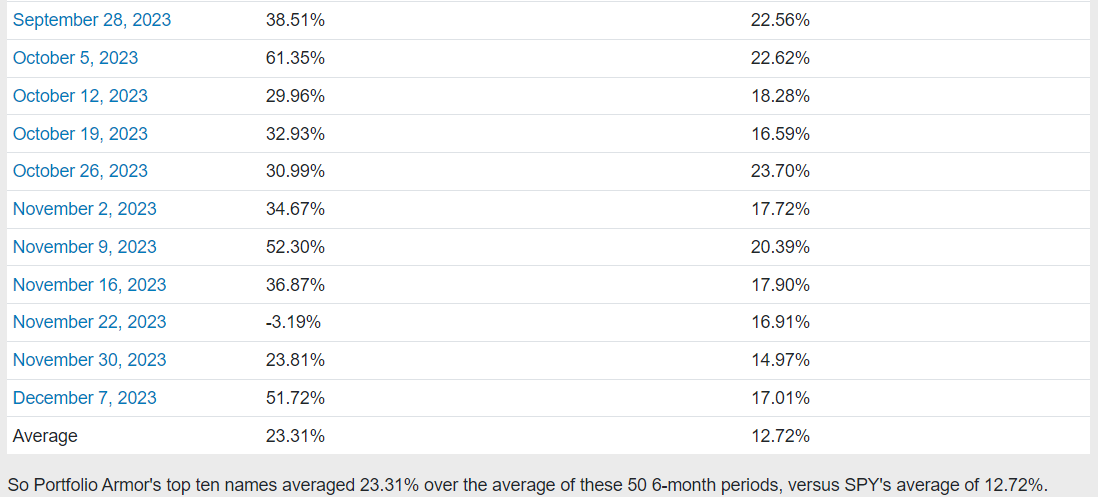

Performance Data From December, 2022

So far, we have 6-month returns for 50 weekly top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 23.31% over the next six months, versus SPY’s average of 12.72%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

Given the strong performance of our top names (nearly doubling the 6-month performance of SPY with each weekly cohort since we started this Substack), in addition to holding underlying top names in our core strategy, I am starting to use them more in options trades, such as yesterday’s copper trade.