Read, Set, Sold

In a Trade Alert email yesterday, I mentioned I had opened a position similar to our successful Redfin trade last week:

A 1DTE Options Trade

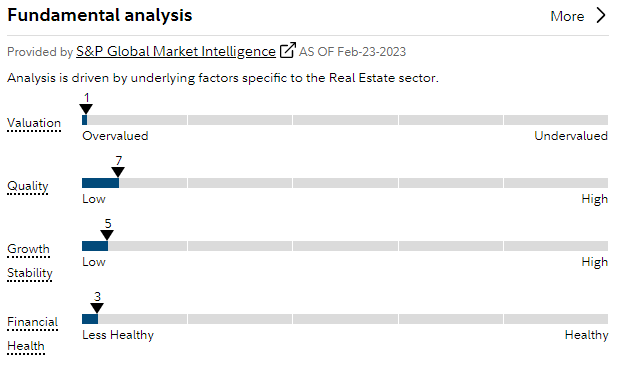

Last week, we bought puts on Redfin Corporation (RDFN) expiring on Friday, and exited that trade for a 29% gain in two days. Today, we bought puts expiring tomorrow on a similar stock in a struggling industry, one with these abysmal fundamentals.

Like Redfin last week, this company is releasing earnings the day before our options expire (after today’s close, in this case). So, if those earnings surprise to the upside, we could lose money on this trade. But, like Redfin, this company is in the real estate industry, which, according to Redfin yesterday, didn’t do well in the 2nd half of 2022 (“U.S. home values declined by $2.3 trillion in 2nd-half of 2022, Redfin says”).

Before we get to today’s trade though, a couple of quick notes on two other trades:

I have a limit order open on another bearish bet, so expect a trade alert on that if and when that gets filled.

Our leveraged bullish bet on natural gas from earlier in the week is up 34% as I type this.

Now for the details on today’s trade.

I bought the $2 strike puts on Opendoor Technologies, Inc. (OPEN) expiring on February 24th for $0.25 each.

The set-ups here were very similar:

Both RDFN and OPEN were money-losing tech stocks in the real estate sector.

Both were up >50% year-to-date after tanking in 2022.

Both were releasing earnings on a Thursday.

We bought slightly in-the-money puts on both expiring the following day.

Both companies actually “beat” their estimates, but posted ugly numbers and guidance, nevertheless, that spooked investors after hours (Opendoor posted a $399 million loss for Q4).

After seeing the premarket trade in OPEN today, I set a limit order to exit my $2 strike 0DTE (zero day to expiration) OPEN puts at $0.40 today. They were filled at that price, for a 60% gain on their $0.25 purchase price.