Trying Our Hand At 0DTE Options

0DTE, or Zero Days To Expiration options have been all the rage recently. In Wednesday’s Trade Alert, we bought something very similar, a 2 days to expiration option:

At the end of Tuesday morning’s post, I mentioned my game plan for Tuesday’s CPI day: if inflation came in hotter than expected, and the market rallied higher, I planned to add a new bearish position, and if the reverse happened, I might exit a previous bearish bet. In the end, the market’s response to the mixed CPI data was relatively muted, and I didn’t place any trades on Tuesday. I did just place one now though.

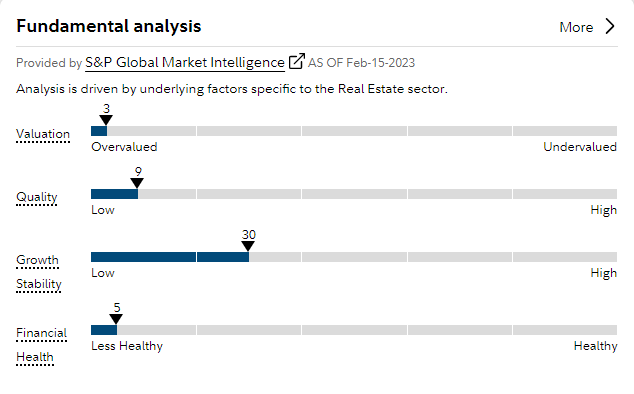

This trade is against a former meme stock, one that has more than doubled year-to-date, despite having these fundamentals:

One difference with this trade is that we’ll know if it has worked by the end of the week. Details below.

The stock is Redfin Corporation (RDFN), and I bought the $10 strike puts expiring on it expiring on Friday, February 17th at $1.20. I bought these when RDFN was trading at about $9.11. Redfin is scheduled to release earnings after the close tomorrow, and the consensus estimate is for another quarterly loss, this time of about $1.08 per share.

Today’s trade is basically a bet on tomorrow’s earnings or forward guidance coming in worse than expected, and since we’ll be out of these options on Friday either way, we’ll know if this worked or not by then.

Well, now we know. RedFin’s earnings actually beat expectations yesterday, but their numbers were nevertheless ugly, as TD Ameritrade’s Oliver Renick noted then.

So the RedFin shares dipped about 5% after hours, and are down about 7% today as I type this. I exited those $10 strike puts expiring today at $1.55, for a 29% profit over their $1.20 purchase price.

I’ll keep an eye out for similar opportunities in the future.