Brigitte Helm during a break in filming Fritz Lang’s Metropolis (1927)

We’ve Profited From AI This Year

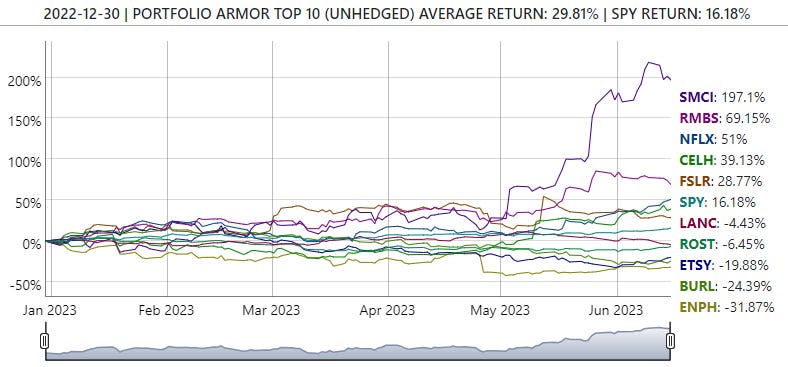

In our core strategy (where we buy underlying stocks) we’ve had success with AI-related names such as Super Micro Computer (SMCI 4.26%↑) and Rambus (RMBS 0.94%↑), as you can see in the performance of our top names from December 30th below (as of yesterday’s close).

Another AI-related name we’ve had success with there is Nvidia (NVDA 0.00%↑). As of Thursday’s close, I was up 85% in the NVDA shares I bought at the end of February as part of our core strategy. What those names have in common is they are “picks & shovels” plays on AI: they manufacture the equipment used to power artificial intelligence.

Beneficiaries of AI

A research report identifying key beneficiaries of AI was published on Friday, and two of the names on it may be familiar to readers of this Substack. One is a name we exited for double digit profits earlier this year, and another is a previous Portfolio Armor top ten name. We’re swinging for the fences with these two, betting smaller amounts than usual while aiming for gains of ~700% to ~1,100% over the next six months.

Details below.

The first name is UiPath Inc. (PATH 0.00%↑), which we exited for a 37% gain after an earnings trade last month.

The trade: a vertical spread expiring on January 19th buying the $25 strike calls and selling the $30 strike calls for a net debit of $0.65. The max gain on 2 contracts is $870, the max loss is $120, and the break even is with PATH at $25.65.

The second name is Enphase Energy, Inc. (ENPH 0.00%↑). The trade: a vertical spread expiring on January 19th buying the $290 strike calls and selling the $300 strike calls for a net debit of $0.83. The max gain on 1 contract is $917, the max loss is $83, and the break even is with ENPH at $290.83. This trade hasn’t filled yet. This trade filled at a net debit of $0.83.

Exiting These Trades

For each debit spread trade, I’m opening a Good ‘till Canceled limit order to close it at a net credit of about 90% of the spread (the difference between the strike prices of the options). In the first trade above, we have a $5 spread ($30 - $25), and 90% of $5 is $4.5, so that’s where I’ll be placing my limit order to exit it. If that order doesn’t get filled over the next several months, I’ll lower the limit price as necessary as we get closer to expiration.

Below is a message from our sponsor, SpreadHunter.

For traders getting started with options and option spreads, SpreadHunter offers a comprehensive and reassuring environment – where asking questions is a plus. Run by ex-CBOE professionals with close to 50 years trading experience (each), we will train you how and why to enter and manage complex options strategies, and how to deal with today's changing and often unpredictable market environment.

To set up a one-on-one live demonstration during market hours, contact David A. Janello, PhD, CFA at david.janello@spreadhunter.com.

For more information:

Interested in opening a TradingBlock brokerage account? Click here:

https://www.tradingblock.com/affiliates/public/spreadhunter.aspx