Jennifer Coolidge, perhaps best known as “Stifler’s Mom” from American Pie (1999), models for one of the companies featured in our earnings trades today.

A Note About Earnings Trades

I’ve been using social data in most of our earnings trades, because studies have shown it offers a slight edge (over 50% success) over time, but I’ve also been looking at fundamental and technical data as well. Going forward, I’m going to be a little more precise with that, so you can decide which of these earnings trades you want to follow along on. For each one, where available, I’m going to give you a figure from 0-10 indicating how bullish or bearish the fundamental and technical data on each stock is. I’ll be taking that info from Chartmill.com.

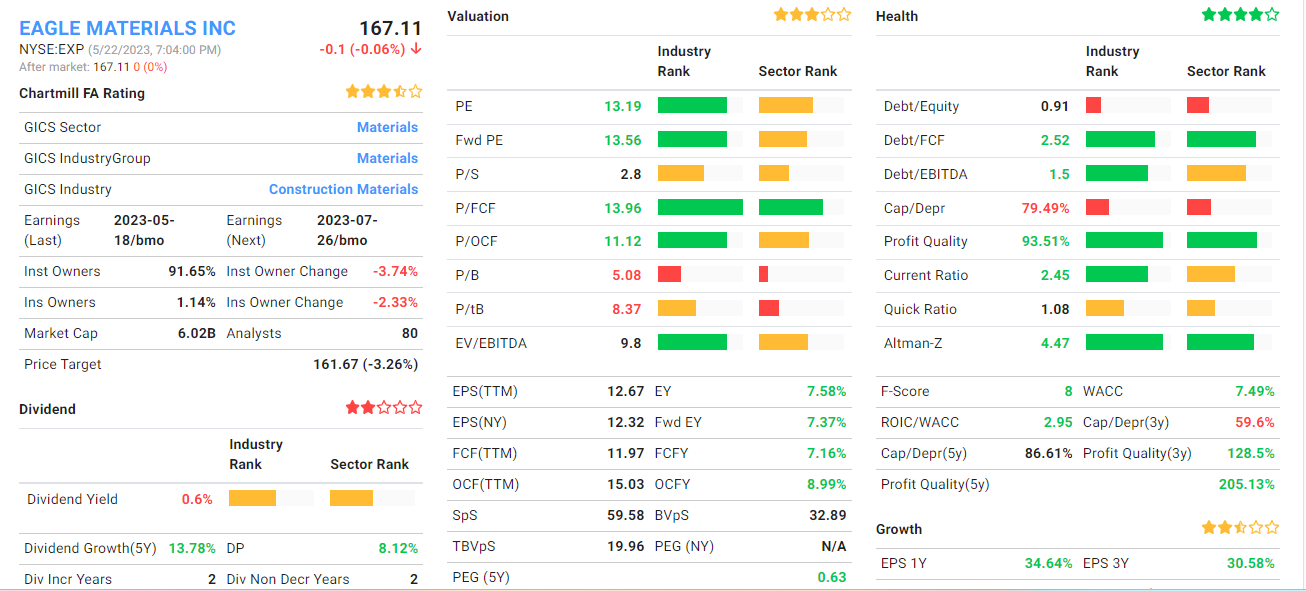

Here’s an example from a stock we bet on last week, Eagle Materials, Inc. (EXP 0.00%↑ ).

Chartmill tracks a whole bunch of fundamental metrics on the company—the screen capture below only shows some of them,

But the site aggregates all of the fundamental metrics into one overall fundamental score, in this case a 7.

It also posts an overall Technical Rating for the stock, in this case, a 9.

Ultimately, though, earnings announcements are discrete events and the fundamental and technical data don’t take into account how the business did since the last earnings report was released. The advantage of social data is it gives us an educated guess into how the business did since then (for example, if there’s a spike in people raving or complaining about the company’s products). But the fundamental and technical rankings offer condensed, useful context, so I’ll aim to give you those numbers going forward.

The first stock we’re betting on today has a Technical rating of 8, and a Fundamental rating of 7, in addition to bullish social data.

Details below.

Earnings Trades

Numerical fundamental and technical rankings via Chartmill.com.

e.l.f. Beauty, Inc. ( ELF 0.00%↑). This is the cosmetics company employing Jennifer Coolidge. Technicals (8), Fundamentals (7), and bullish social data. The trade: a spread expiring on June 16th buying the $85 strike calls and selling the $90 strike calls for a net debit of $2.35. The max gain on 2 contracts is $530, the max loss is $470, and the break even is ELF at $87.35.

UiPath, Inc. ( PATH 0.00%↑). Automation software company. Technicals (6), Fundamentals (4), and bullish social data. The trade: a spread expiring on June 16th buying the $15 strike calls and selling the $20 strike calls for a net debit of $2.05. The max gain on 2 contractis is $590, the max loss is $410, and the break even is PATH at $17.05.

Abercrombie & Fitch Co. (ANF 0.00%↑). This is the apparel company that used to hire attractive models. Technicals (0), Fundamentals (3), and bearish social data. The trade: a spread expiring on May 26th buying the $23 strike puts and selling the $22 strike puts for a net debit of $0.48. Max gain on 7 contracts is $364, max loss is $336, and the break even is ANF at $22.52.

Exiting These Trades

For each earnings trade, I’m opening a Good ‘till Canceled limit order to close it at a net credit of about 85% of the spread (the difference between the strike prices of the options). In the case of ELF, for example, we have a $90 strike option and an $85 strike option, so the spread is $5. 85% of $5 is $4.25, so that’s where I’m placing my limit order to exit this trade. If that order doesn’t fill the day after earnings, I’ll lower the limit price as necessary.

Below is a message from our sponsor, SpreadHunter.

For traders getting started with options and option spreads, SpreadHunter offers a comprehensive and reassuring environment – where asking questions is a plus. Run by ex-CBOE professionals with close to 50 years trading experience (each), we will train you how and why to enter and manage complex options strategies, and how to deal with today's changing and often unpredictable market environment.

To set up a one-on-one live demonstration during market hours, contact David A. Janello, PhD, CFA at david.janello@spreadhunter.com.

For more information:

https://spreadhunter.com

Interested in opening a TradingBlock brokerage account? Click here:

https://www.tradingblock.com/affiliates/public/spreadhunter.aspx

I'm a bit confused . If bearish why sell the 22 ANF puts and buy the 23? Wouldn't it be the opposite if you're expecting the price to fall?

Out of the PATH call spread for a net credit of $2.80 today, for a gain of 37%.