Trade Alert: Another Bet On A Homebuilder

A shortage of inventory despite higher mortgage rates.

Binyamin Mellish/Pexels.

Still More Home Buyers Than Sellers

At the end of last month, we placed a bet on a homebuilder based in part on its chart and fundamentals, as well as on the supply and demand characteristics of the housing market:

You might think that, given the rise in mortgage rates over the last year, there would be more supply than demand, but it turns out that’s not the case. As [Altos Research founder Mark] Simonsen says in the video, supply is pretty tight, as fewer homeowners are selling now than in the past.

With that in mind, I thought it might make sense to make a bullish bet on a homebuilder. I found one with a strong chart as well as solid fundamentals.

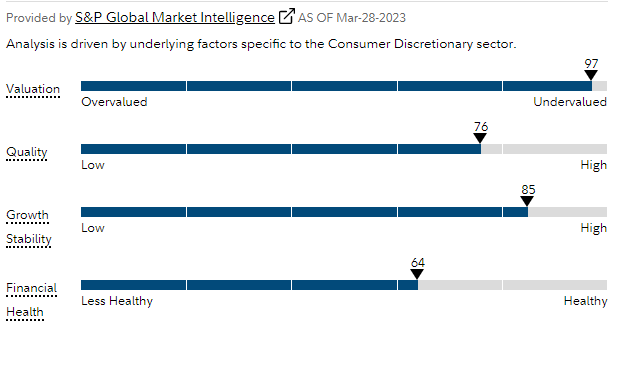

The company’s fundamentals are actually better than the figure above implies, since it has a perfect Piotroski F-Score of 9 (recall that we’ve looked for Piotroski scores below 2 on some bearish bets recently).

In his latest video, Mark Simonsen reiterates his call about low home inventory and consistently strong demand.

With that in mind, I placed another trade on the same homebuilder. The difference is that this one doesn’t require the stock to move as much for us to make a profit—essentially, if it’s trading higher than its current price after it posts earnings later this month, this trade will be profitable.

Details below.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.