Binyamin Mellish/Pexels.

Note: Unlocking this post as I just exited the position. Still bullish on this company, though, and may bet on it again in the future.

Surprising Real Estate Data

Mike Simonsen of Altos Data presented some surprising data in the video below on Monday.

You might think that, given the rise in mortgage rates over the last year, there would be more supply than demand, but it turns out that’s not the case. As Simonsen says in the video, supply is pretty tight, as fewer homeowners are selling now than in the past.

With that in mind, I thought it might make sense to make a bullish bet on a homebuilder. I found one with a strong chart as well as solid fundamentals.

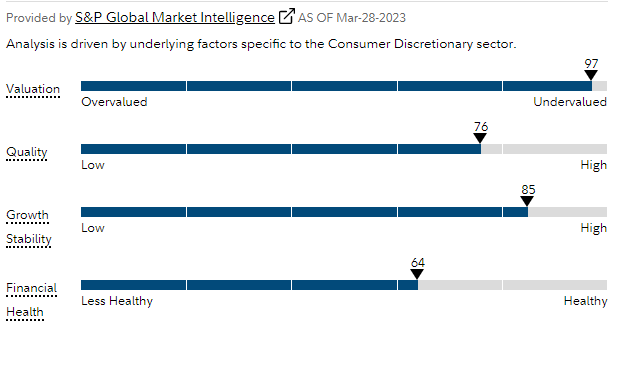

The company’s fundamentals are actually better than the figure above implies, since it has a perfect Piotroski F-Score of 9 (recall that we’ve looked for Piotroski scores below 2 on some bearish bets recently).

A risk here is obviously that our regional banking crisis spreads in such a way that it tanks the market, but if that happens, our recent bearish bets, including ones on a few regional banks, should benefit. A bullish bet on this company gives us the potential to profit if the crisis gets resolved (It’s possible, as I think Jim Bianco is suggesting here, that rather than have more big bank failures, we’ll have a continued drip of deposits leaving which will hammer regional bank earnings).

Details on the trade below.

The home builder is Taylor Morrison Home Corporation (TMHC). I bought the $45 strike, October expiration calls on it at $1.55.

If you decide to place this trade, use only an amount you’d be willing to lose. If we’re wrong, these calls will expire worthless. A good rule of thumb for position sizing in a trade like this: if you’re comfortable investing $ X in a stock with a 10% trailing stop, don’t put more than $0.1X in this.

Exited these calls at $3.50 for a 126% gain today, but I probably sold too soon. Elaborating in a new post.

The bid is 2.70, Mid 3.50 & Ask is 4.30. You got yours @ 1.55? suggestions whether to go in or not & if so, midpoint or ask? Ask is $330.65

stock is down $0.80