Trade Alert: Betting Against A Bond Insurer

Taking advantage of the market rally to add a short position.

Thinking about those Puerto Rican municipal bonds his firm insured.

A Post-Earnings Trade

In our previous post (Predicting Price Movements Post-Earnings), I mentioned that I didn’t see any compelling (pre-) earnings trades this week, but did have a bearish trade in mind.

Predicting Price Movements Post-Earnings

Our Ten Signals For Evaluating Earnings Trades We’ve been using these nine signals, or metrics, to evaluate potential earnings trades, but for one of them, Zacks Earnings ESP (Expected Surprise Prediction), I had been noting the stock’s Zacks ranking as well if it were other than 3 (neutral). I’ve now broken out Zacks rankings as a separate, tenth, signa…

The challenge with the (pre-) earnings trades we’ve been doing recently is that ultimately, you don’t know what the company will report. In the case of today’s company, it reported earlier this month, so we know: it missed on top and bottom lines, and crashed 13% overnight. But now it’s back above its pre-earnings price on no news, just riding the recent stock market rally.

This company is a financial insurer that, among other things, insures municipal bonds.

Weak Fundamentals

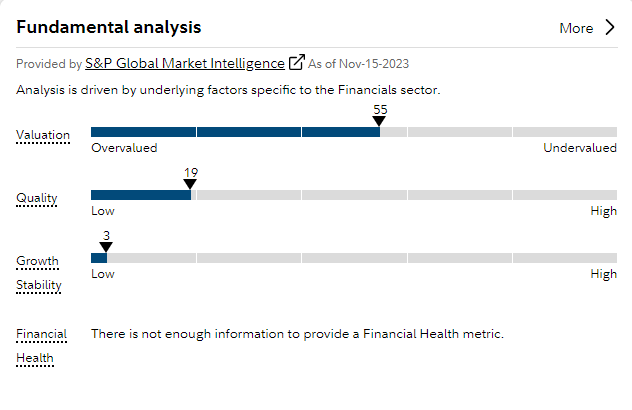

S&P Global Market Intelligence doesn’t rate the company’s financial health…

…But Chartmill does. On a scale from 0-to-10, with 0 being the worst, here’s how our insurer ranks:

Overall Fundamentals: 1

Health: 1

Growth: 2

Valuation: 1

In addition, it has a Piotroski F-Score of 2, indicating financial distress, and Portfolio Armor’s gauge of options market sentiment is bearish on it. I am placing two trades on it, one a bet that the stock doesn’t rise much higher than it is currently, and another a bet that it declines.

Details below.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.