Trade Alert: Betting Against An Electric Car Co.

(Not Tesla). Plus a note about balancing time versus time decay in our options trades.

Time Versus Time Decay

Before I get to today’s trade, a note about what I’m trying to balance in general with options trades going forward. Namely,

Allowing more time for fundamentals to play out. We got Bed Bath & Beyond (BBBY 0.00%↑ ) right directionally earlier this year, and even timed the top in the stock, but we exited with smaller gain than we could have had we used longer dated options, ones with expirations later than now, when the stock is about to be delisted.

Avoiding time decay. If you buy long-dated put or call options, and the stock doesn’t move quickly in the direction you’re betting it will, your options will tend to lose value. You can still profit if you get the move you’re betting on in the stock before expiration, but in the meantime, if you’re sharing your trades in a Substack like this, your subscribers will get understandably antsy.

One thing I’ve been doing recently in response to this is using spreads more often in lieu of simply buying options, as they’re cheaper than just buying the higher-strike option, and time decay works in our favor with the short leg of the spread (there are some cases where it still makes sense to use straight options though).

Even with spreads, we still have the trade off of time versus time decay of the long option position: it will be cheaper to open a spread expiring shortly after the stock’s upcoming Q1 earnings report, than it will be to open a spread now expiring after its Q2 earnings report, but the one expiring after the Q2 report gives us more time for the fundamentals and any macro trends working in our favor (e.g., deposit flight in the case of banks) to play out.

With that in mind, I decided to split the difference with today’s trade, placing one put spread expiring right after its Q1 earnings and one expiring after its scheduled Q2 earnings. I’m also using a new signal, one that, in hindsight, could have kept us out of a losing electric car trade last week.

Adding Social Data To Our Armamentarium

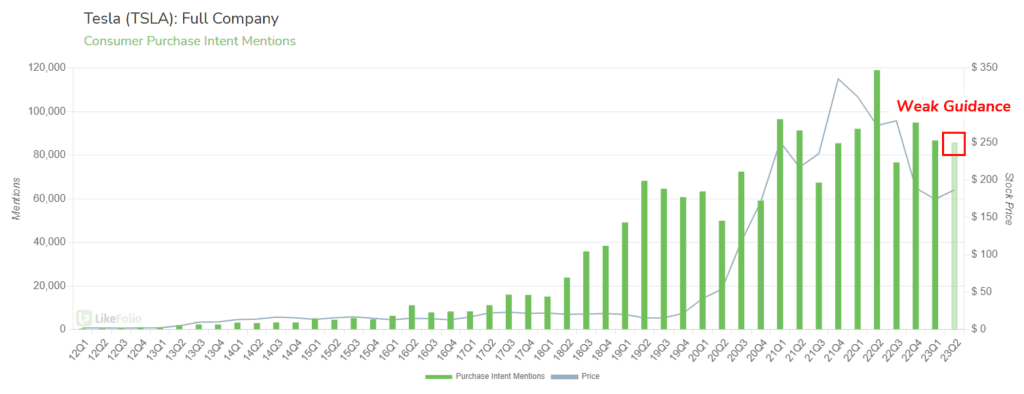

Over the last week, we’ve had two winning earnings trades on First Republic Bank ( FRC 0.00%↑ ) and one losing trade on Tesla ( TSLA 0.00%↑ ) . I got Tesla wrong, but social data analysis firm LikeFolio didn’t. As they wrote here,

LikeFolio measures the change in key consumer metrics, like buzz, demand, and sentiment, to quantify company-level momentum.

Georgetown University referred to this as the “unexpected component of sales growth” when it reviewed LikeFolio metrics. […]

During the first week of 23Q2 earnings season, LikeFolio accurately predicted the loss of momentum for two major companies: Netflix and Tesla. […]

While LikeFolio data can’t speak to Tesla’s margins, it can speak to the number of consumers purchasing a Tesla vehicle.

Unfortunately for Tesla, demand appeared to be waning in the early days of the second quarter.

You can see this highlighted on the chart below:

This slowdown in demand growth translated to a TSLA Earnings Score of -42: Bearish.

TSLA shares sank following the earnings print.

So, from now on, I’ll be taking LikeFolio’s data into consideration, when it’s available for a particular stock. The electric car company I bet against today has bad technicals and fundamentals (including a Piotroski F-Score of 2 (you may recall scores of 2 and below indicate weakness). In addition, LikeFolio’s social data is bearish on it too, and not in the way it was with Tesla. LikeFolio sees Tesla as the leader in its industry that happened to have a weaker than expected quarter; it sees the electric car company I bet against today as a “wannabe Tesla that can’t catch a break” and is headed sharply lower.

Here’s how I’m trading it:

The company is NIO, Inc. ( NIO 0.00%↑ ), a Chinese electric car company. It's releasing earnings before the open Friday morning. I opened two put spreads on it, one expiring immediately after this week's earnings, and one expiring after next quarter's expected earnings date:

(Update: if you haven’t placed this one yet, please don’t. See my comment below for more detail.) April 28th Expirations: I bought the $7.50 strike puts and sold the $6.50 strike puts for a net debit of $0.08. The maximum gain on 15 contracts is $1,380, the maximum loss is $120, and the break even is with NIO trading below $7.42.

June 16th Expirations: I bought the $7.50 strike puts and sold the $5 strike puts for a net debit of $0.61. The maximum gain on 3 contracts is $587, and the maximum loss is $183, and the break even is with NIO trading below $6.89.

IMPORTANT NOTE TO NEW (and experienced) OPTIONS TRADERS:

Close out all winning In the Money or Close To The Money Options Positions That Expire Today.

If you have a completely in-the-money-on-both-legs Vertical DO NOT let it go into expiration assuming it will auto-exercise. Pay 0.01-0.03 to go home flat. If you have an options position that is a little bit out of the money and it looks like it is going to zero sell it for 0.01 or even 0.00 to get out of the position.

Not exercising and assuming everything will auto-ex is the biggest source of trading group wipe-outs.

Hey everyone, a couple of quick addendums to this post:

1) It looks like I made a mistake with the NIO spread expiring today. Some sites were indicating that it was releasing earnings today, but it looks like today's filing was its 2022 annual report, which doesn't have a lot of new earnings info because the Q4 2022 earnings were released separately in March. So our NIO spread expiring today is probably going to be a bust. Sorry about that. The other NIO spread expires after NIO's scheduled Q1 earnings so, we should get an earnings move one way or another with that one, and I remain bearish on NIO and will continue to hold the June expiration spread.

2) David Jannello writes nearby that we should give up $0.01-$0.03 on our spreads to close them out before expiration. He runs a company that specializes in spreads, so I will defer to him on this and take his advice, and suggest you do the same.