Copper Again

Before last week’s copper stock ended up in Portfolio Armor’s top ten names, I placed a good ‘till canceled (GTC) options trade on another copper miner, one that had the best fundamentals in the industry: an overall fundamental rating of 7 (out of 10) by Chartmill, a profitability rating of 9, a health rating of 8, and a valuation rating of 7. That trade filled today, and you can find the details on it below the paywall. For the general case for copper, see last week’s post below.

Trade Alert: Copper

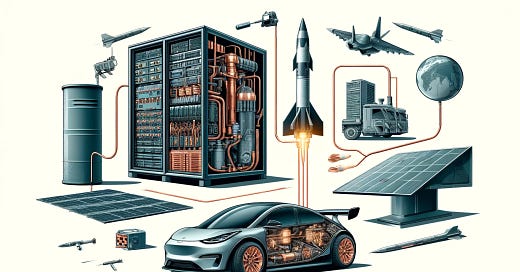

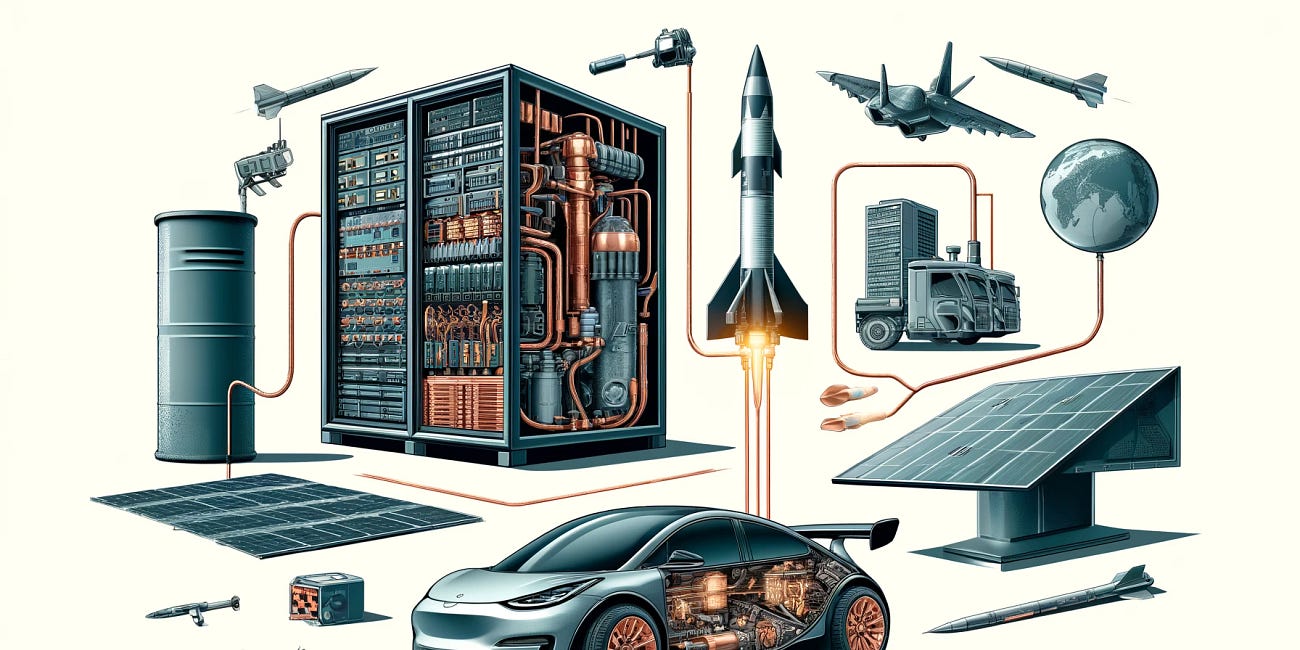

The Case For Copper In an article last month (“Copper: Why A Multi-Year Bull Market Looms”), Zacks author Andrew Rocco quoted the legendary hedge fund manager Stanley Druckenmiller on the case for copper: Copper is a pretty simply story. Takes about 12 years, greenfield to produce copper, and you got EVs, the grid, data centers, and believe it or not munitions. These missiles all got enough copper in them and the world’s getting hot that we just think the supply-demand situation is incredible for the next five or six years.

A Bonus Top Names Trade

Portfolio Armor has two basic ways of gauging options sentiment: it looks for securities that are relatively inexpensive to hedge with puts, and those that are inexpensive to hedge with tight collars. To over simplify, the first gauge suggests the security has less downside risk, and the second gauge suggests it has more upside potential. Since there’s also a momentum component to our screens, most of the securities that pass one of those gauges pass the second one. Last night, we had a rare security pass the first one. It was the only one that was so inexpensive to hedge with puts, that it was cost-effective to hedge that way against a >7% decline.

That stock—a midcap in the IT space—beat on both top and bottom lines when it released earnings at the end of April, and hit an all-time high in May after announcing it had landed a large contract with the U.S. Army. Since then, it has pulled back about 5%.

The options market’s expected move for it after its next earnings release at the end of July was about 7.3% in either direction as of yesterday’s close. Our bet on it today is that it posts another earnings beat next month and its stock climbs about 7.3% from today’s price after that earnings release. If that happens, we’ll have a gain of about 200% on our trade (our maximum loss on this trade if that doesn’t happen is 100%).

Details below.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.