Go Woke, Don’t Go Broke?

Before we get to today’s earnings trades, in case you missed it, we shared a guest post from our friend from Chicago, David Janello, PhD, CFA, on ZeroHedge on Wednesday: Worse Than Bud Light: Lululemon's Sponsoring A Queer Festival Featuring Children. David’s prediction is that, unlike Anheuser Busch (BUD 0.00%↑) with Bud Light, Lululemon Athletica (LULU 0.00%↑) will get away with this because of its more liberal client base. We’ll see. One slightly Orwellian note to this: after submitting that post, I got an email from ZeroHedge informing me that they had to remove “queer” from the title, due to some issue with Google. That seemed odd to me considering that the festival in question has the word “queer” in its title.

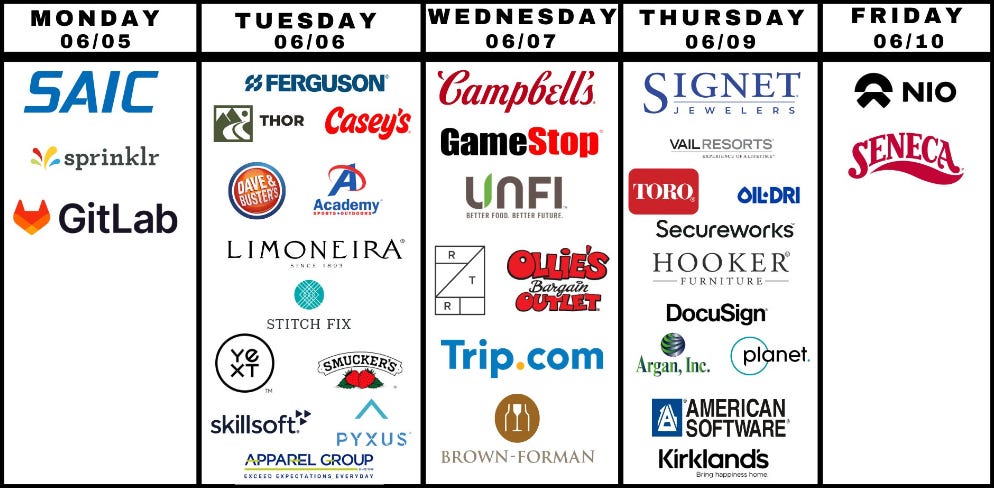

Now on to our last two earnings trades for this week.

Two More Bearish Earnings Trades

As with yesterday’s trades, we started with social data to identify these names, and then looked at a few other indicators for confirmation:

Aggregate fundamental and technical ratings from Chartmill.

Earnings Surprise Predictions from Zacks.

Options sentiment from Portfolio Armor.

For these stocks, the social data and fundamentals are both bearish, but the other indicators are mixed: one has a negative earnings surprise prediction from Zacks, the other neutral, etc. I’m betting against both, but I’ve laid out the details on each so you can decide if you want to bet against either or both of them.

Details below.

DocuSign, Inc. (DOCU 0.00%↑). Bearish social data, Fundamental 3, Technical 6, Zacks ESP -7.55%, PA options sentiment positive. The trade: a spread expiring on June 16th buying the $58 strike puts and selling the $57 strike puts for a net debit of $0.50. The max gain on 7 contracts is $350, the max loss is $350, and the break even is with DOCU trading at $57.50.

This one hasn’t filled yet. This was partially filled.NIO Inc. (NIO 0.00%↑). Bearish social data, Fundamental 2, Technical 0, Zacks ESP 0%, PA options sentiment negative. The trade: a spread expiring on June 16th buying the $8 strike puts and selling the $7 strike puts for a net debit of $0.44. The max gain on 8 contracts is $448, the max loss is $352, and the break even is with NIO trading at $7.56.

I’m also still holding the second NIO trade I listed in the post below, but the one above doesn’t require NIO to drop as much for you to profit from the trade.

Exiting These Trades

For each trade, I’m opening a Good ‘till Canceled limit order to close it at a net credit of about 90% of the spread (the difference between the strike prices of the options). In both of the trades above, we have $1 spreads, and 90% of $1 is $0.90, so that’s where I’ll be placing my limit order to exit each trade. If that order doesn’t get filled after earnings, I’ll lower the limit price as necessary as we get closer to expiration.

Below is a message from our sponsor, SpreadHunter.

For traders getting started with options and option spreads, SpreadHunter offers a comprehensive and reassuring environment – where asking questions is a plus. Run by ex-CBOE professionals with close to 50 years trading experience (each), we will train you how and why to enter and manage complex options strategies, and how to deal with today's changing and often unpredictable market environment.

To set up a one-on-one live demonstration during market hours, contact David A. Janello, PhD, CFA at david.janello@spreadhunter.com.

For more information:

Interested in opening a TradingBlock brokerage account? Click here:

https://www.tradingblock.com/affiliates/public/spreadhunter.aspx

DOCU beat earnings and revenue estimates yesterday but dipped today. Exited that spread at $0.62 for a gain of 24%.