Portfolio Armor’s Top Ten Names

As regular readers know, every day the market is open, the Portfolio Armor system analyzes estimates a 6-month return for every stock and exchange traded product with options traded on it in the U.S. Since Each Thursday (except for market holidays), I post the top ten names from that day’s scan here.

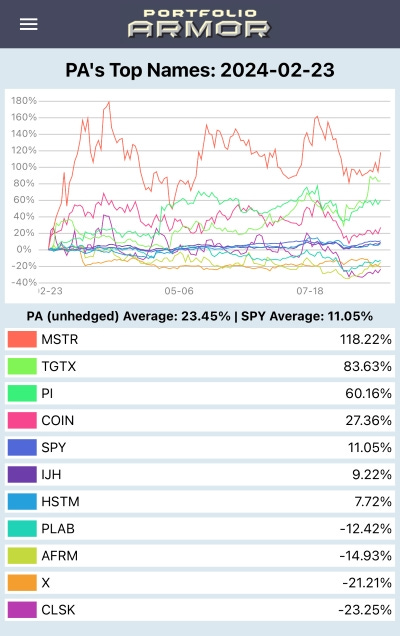

So far, we have 6-month returns for 61 weekly top names cohorts since we started this Substack at the end of December, 2022, and our top names have averaged returns of 21.22% over the next six months, versus SPY’s average of 12.83%.

Our most recent top names cohort to beat the market over the next 6 months was this one, from late February.

Screen capture via the Portfolio Armor iPhone app.

If we’re lucky, one more of the names below will do as well as the top three there did, but we don’t need them to do that well to make over 100% on our options trades.

On Monday, three names on our top ten caught my eye:

A mega cap releasing earnings this week. This stock has excellent fundamentals (Chartmill gives it an 8 out of 10) and technicals (10 out of 10). Zacks is slightly less bullish about its earnings than Wall Street, but Estimize is more bullish than Wall Street, as it has been over the last four quarters. In each of those four quarters, the company’s actual earnings have been higher than Estimize’s estimate. This one seems like a coin flip to me, but with our trade, it will be a heads we win 2x, tails we lose x coin flip.

A midcap with excellent technicals (10 out of 10) and middling fundamentals (5 out of 10).

A small cap with middling technicals (5 out of 10) and fundamentals (5 out of 10), but a valuation rating of 8 out of 10, because it’s trading at less than 0.8x tangible book value. This is the most interesting of the three to me, because it’s very rare that a company trading below book value ends up in our top ten.

I’ve got bullish trades on all three, with expirations ranging from the end of this week for the first one, to several months out for the third one.

Details below.

Bullish Trade #1

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.