Dids/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

Fabrinet (FN 0.00%↑). Bought for $167.12 on 11/10/2023; stopped out at $181.44 on 2/6/2024. Profit: 8.6%

Options Trades

Call spread on Snap (SNAP 0.00%↑). Entered at a net debit of $0.22 on 2/6/2024; expired worthless on 2/10/2024. Loss: 100%.

Call spread on Affirm Holdings (AFRM 0.25%↑). Entered at a net debit of $0.20 on 2/8/2024; expired worthless on 2/9/2024. Loss: 100%.

Call spread on ELF Beauty (ELF 0.00%↑) (buying the $172.50 strike calls and selling the $175 strike calls). Entered at a net debit of $0.90 on 2/5/2024; exited at a net credit of $1.00 on 2/8/24. Profit: 11%.

Call spread on ELF Beauty (ELF 0.00%↑) (buying the $162.50 strike calls and selling the $165 strike calls). Entered at a net debit of $1.10 on 2/5/2024; exited at a net credit of $2.24 on 2/8/2024. Profit: 104%.

Call spread on Estée Lauder (EL 0.00%↑). Entered at a net debit of $0.40 on 2/2/2024; exited at a net credit of $0.95 on 2/5/2024. Profit: 138%.

Put spread on NetGear (NTGR -10.69%↓). Entered at a net debit of $0.35 on 2/7/2024; exited at a net credit of $0.85 on 2/8/2024. Profit: 143%.

Comments

Stocks or Exchange Traded Products

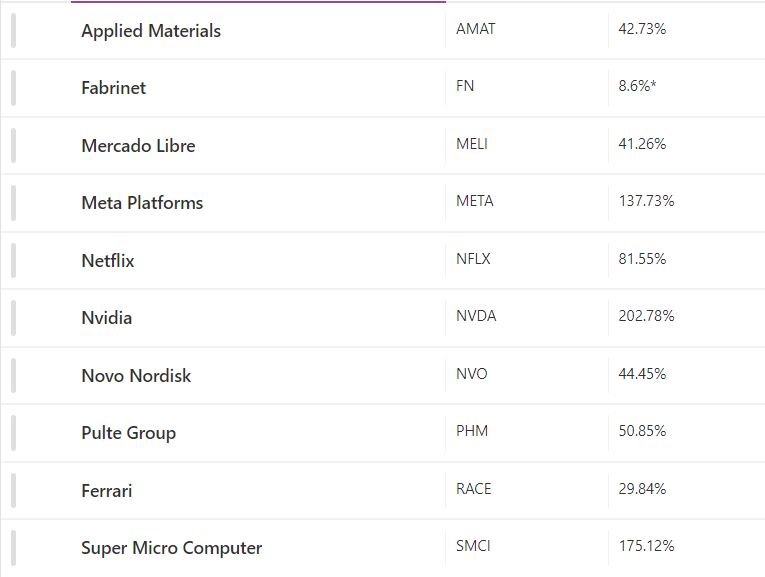

Fabrinet was one of the Portfolio Armor web app's top ten names that we held in our core strategy, which is to put trailing stops on them and replace them with new PA top names when we get stopped out. These are the current returns on our top name holdings:

*Fabrinet return is as of when we were stopped out on Tuesday; the other returns are as of Thursday's close.

Options Trades

Overall, our composite score worked well this week. It’s one big miss was Snap (SNAP 0.00%↑), which defied multiple bullish signals with another implosion. Our composite score actually got Affirm Holdings (AFRM 0.25%↑) right, which was up on the week. The problem was most of its gains came before it released earnings, and I made the mistake of chasing the trade despite the stock being up about 10% pre-earnings. Lesson learned there.

As always, all the results from the stocks we researched this week will go into our spreadsheet, and we’ll adjust the weightings we give our signals based on how stocks exhibiting those signals performed this week.