Trade Alert: Top Names

A heads we make >200% in six weeks, tails we lose 100% options trade on our #2 name.

Doing More With Our Top Names

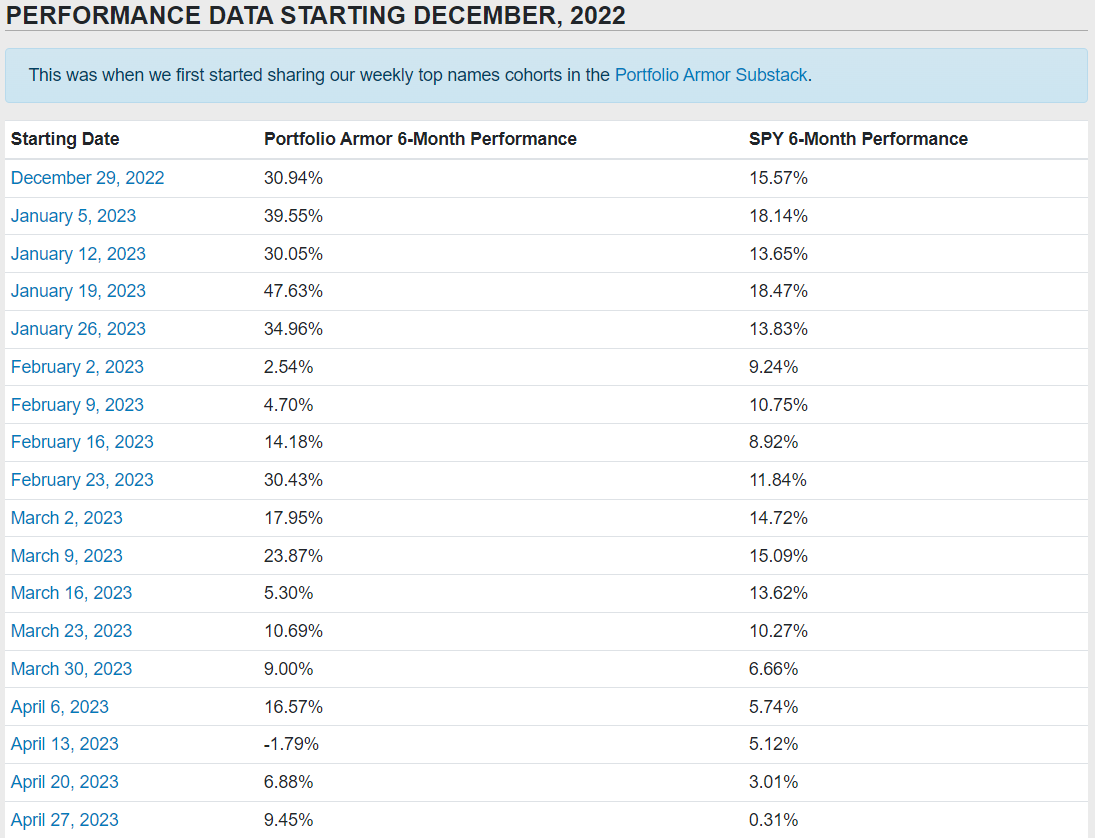

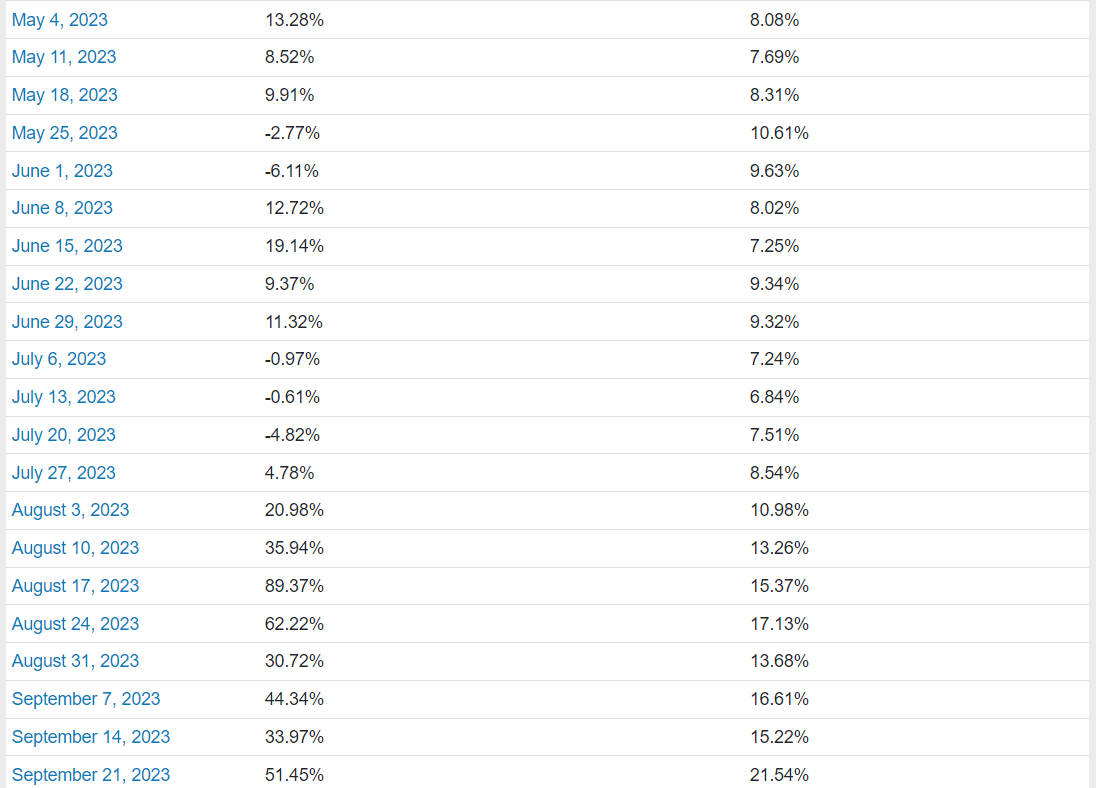

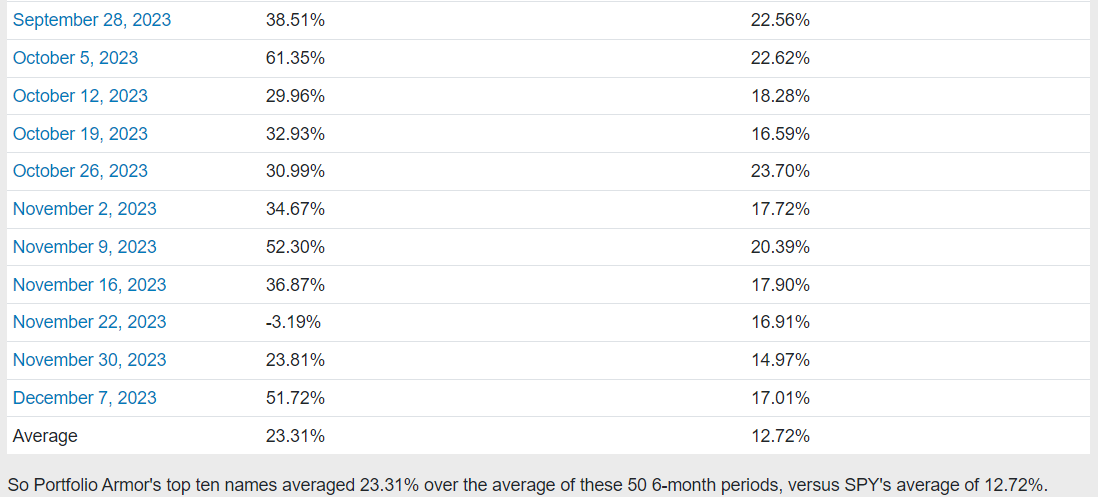

In a post last weekend (“Top Names Performance Update”), I updated the performance of our top names:

Performance Data From December, 2022

So far, we have 6-month returns for 50 weekly top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 23.31% over the next six months, versus SPY’s average of 12.72%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

And I wrote there, because of the strong performance of our top names, I was going to be using them more in options trades.

Given the strong performance of our top names (nearly doubling the 6-month performance of SPY with each weekly cohort since we started this Substack), in addition to holding underlying top names in our core strategy, I am starting to use them more in options trades, such as yesterday’s copper trade.

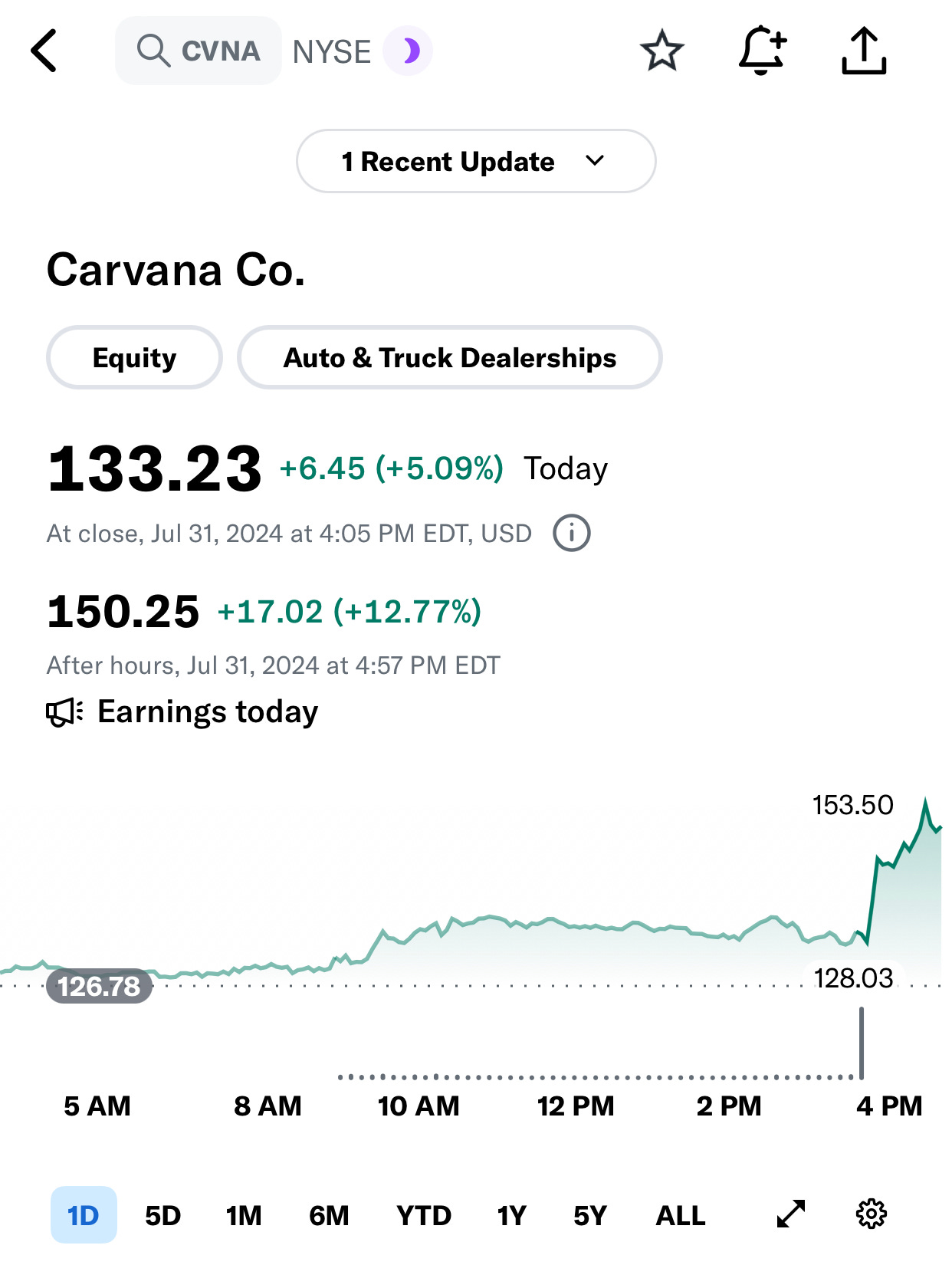

Here’s another example of that. Today’s trade is on our #2 name from last night. The options market expects a move of about 20% over the next six weeks (a period that should include its next earnings release), and our bet is that that movement will be to the upside.

Details below.

The company is Carvana (CVNA 0.00%↑) and the trade is a vertical spread expiring on August 2nd, buying the $120 strike calls and selling the $121 strike calls for a net debit of $0.30. The max gain on 10 contracts is $700, the max loss is $300, and the break even is with CVNA at $20.30. This trade filled at $0.30.

Exiting This Trade

I’m going to set a GTC order to exit at $0.90 or $0.95 and lower the price if necessary as we approach expiration.

Exited at a net credit of $0.96, for a gain of 220%.