"You're thinking of this place all wrong, as if I had the money back in a safe. Your money's in Web3 innovations, it's in startups empowering women" —Delicious Tacos, riffing on the bank run scene in “It’s a Wonderful Life”.

How Not To Save The Banks

In a previous post (“Preventing The Next Bank Collapse”), I shared a view that has become more common recently (for example as expressed by the former Barclays CEO below), that the way to save mid-sized banks was to extend FDIC deposit insurance to accounts larger than $250k.

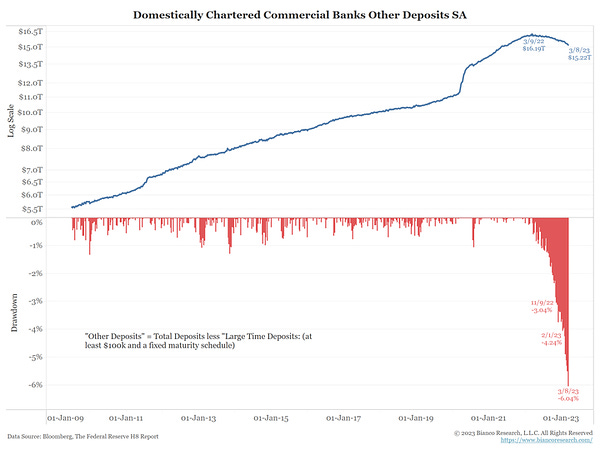

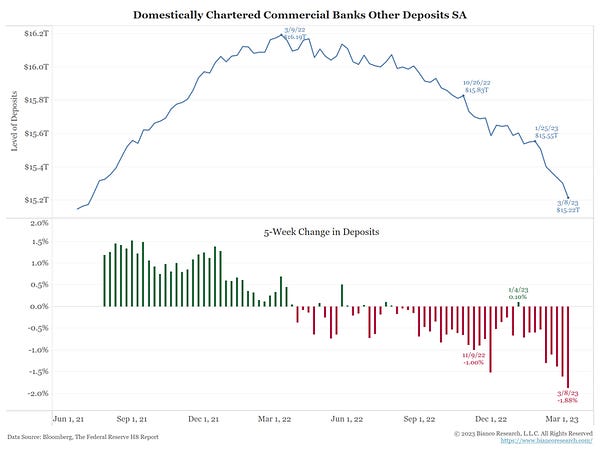

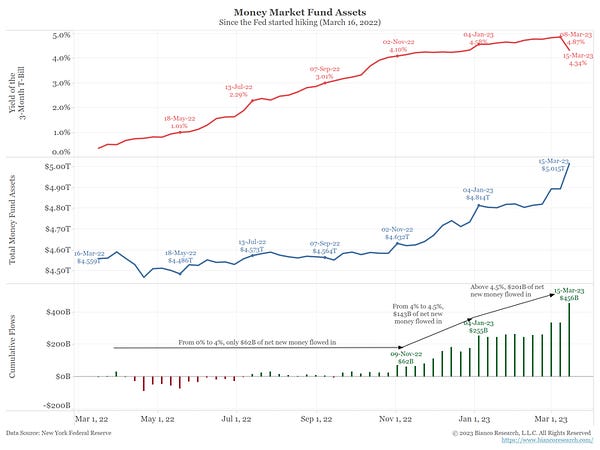

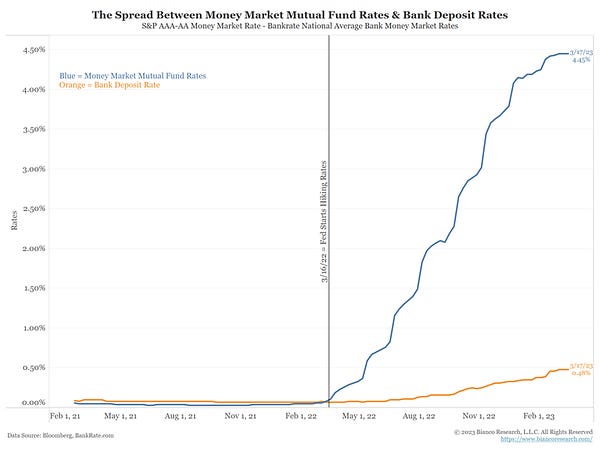

But apparently the lack of FDIC insurance for larger accounts isn’t what started the deposit flight, as Jim Bianco shows in the thread below.

That last tweet by Bianco uses the longer format, so let me quote the text below, because I’m not sure I entirely agree with him regarding the consequences of this:

The[y] already downloaded the app, they reset their password, they figured out how to move money. They are not going to unlearned it.

The only thing that stops the constant bleed is to close the saving rate to market rate gap. With the Fed hiking tomorrow, the only way to close this is for banks to hike deposit rates. But that kills profitability.

----

Why does it matter if the regional banks bleed deposits?

Goldman: Small, Medium Banks Account For 50% Of C&I Lending 45% Of Consumer Lending 80% Of All Commercial Real Estate Lending

If regional banks keep bleeding deposits, even it is slow enough that they don't fail, it will lead to a credit contraction for these sectors. That will hurt.

This is a liquidity crisis (everyone wants their money), not a solvency crisis (banks lost money).

But the scars are so deep from 2008 that we must change this to a solvency crisis .. via the lack of duration hedging. This is not the problem!

The problem is the record bleed out of deposits and mobile banking making the velocity of deposits much higher than any previously imagined.

The risk is a credit contraction.

The solution is to close the savings rate/market rate spread to remove the incentive to leave.

The Problem and the Solution

As Bianco says, the problem is that the regional banks aren't paying enough interest to retain deposits, and the solution is for them to pay more. That part is simple enough, and I agree with it. But I'm not sure I agree with the credit contraction part of it. I think the credit contraction has already happened, and that's why the banks are paying so little on their deposits.

Think about it. The basic business model for a bank is pretty simple: lend money at X% (where X is high enough to cover the default ratio and other expenses) and pay interest on deposits at Y%, where X > Y. The higher X is, the higher Y can be.

The nice part of lending money to consumers and businesses if you're a bank is that you can charge them higher rates than the government pays you when it borrows from you (i.e., when you buy Treasuries). That, in turn, enables you to pay higher rates on your deposits. That the regional banks have been holding so much in Treasuries and other long-dated securities suggests they had more in deposits than they could profitably lend out in their communities.

That in turn suggests that we have too many regional banks, and some consolidation wouldn't be the worst thing for the economy.

Steady As She Goes

With that in mind, I'm comfortable with my current bearish bets on a few regional banks, and am keeping an eye out for other opportunities to bet against regional banks.

Fuck saving the banks

Deposit insurance was so that ma&pa would take their money out of the mattress and bring back to the banks;

During 1929 post depression, all confidence in banks was lost, only those that had cash in the mattress could buy crap;

It's took decades before USA gov restored 'confidence'

Banks&bankers are going to do what they always have done 'steal deposits', & customer assets, the insurance is supposed to protect the little people

Now we're told there is no longer a $250k cap, so that means everybody is covered and of course nobody is covered; So now we're back to 1929 all over again, and the smart will get their cash out and stash where only they have access;

Criminals running the GOV? who knew?

FDIC is a joke, even with the $250k cap, there was never enough 'cash' to cover more than 3% of the people in line; What they're doing right now is dropping expectations, they know collapse is coming soon; Sure they can 'print' to infinity, but the problem is USA imports everything, and nobody wants to trade toilet-paper for hard goods;

What's happened at SVB is just that they were the bank of the "CIA" called inQtel, basically a money laundering operation, but $300B; They know collapse is coming so CIA insiders of SV ( Thiel ) got their cash out and bought GOLD;

Cash-Reserves for insurance are pretty much zip at this point, so now sure the FED-RES will create a back-door to fund all 'banks', but the truth is only the BIG-BANKS can ramp up the 'computers/networks' quick enough to meet demand of outflows;