Slyzyy/Pexels

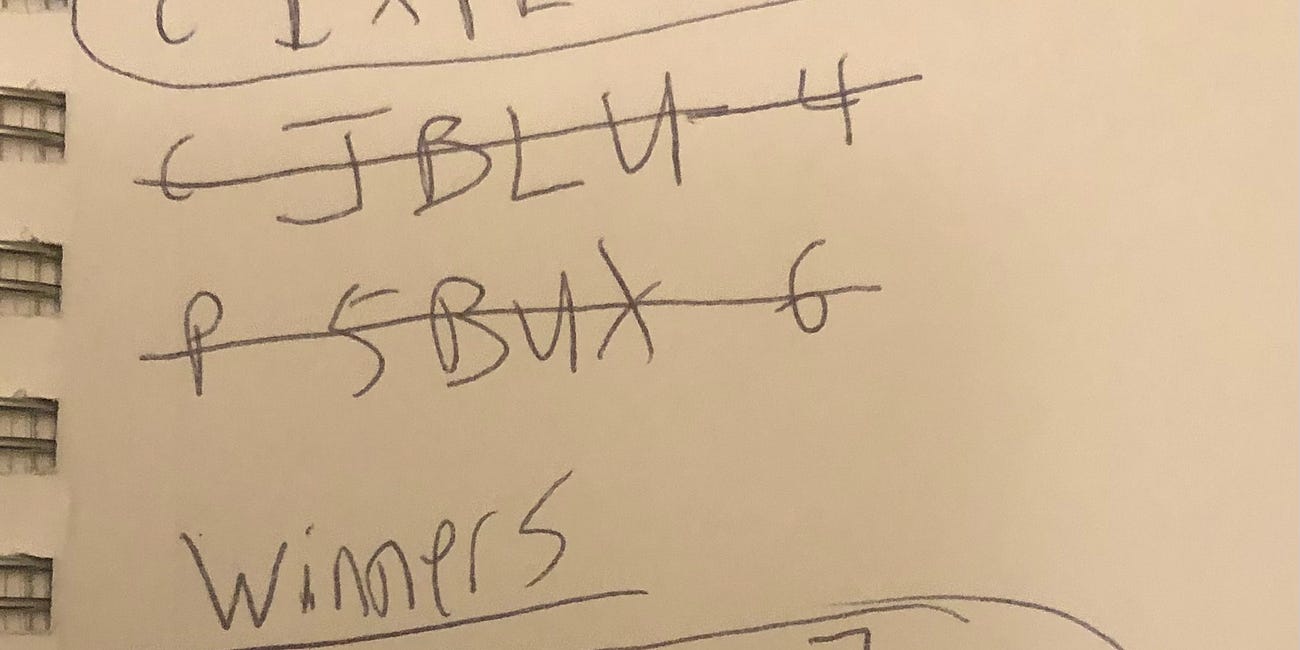

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

Mettler-Toledo International (MTD 0.00%↑). Bought at $1,452.07 on 3/17; sold at $1,249 on 8/10. Loss: 14%.

Options Trades

Put spread on Lucid Group (LCID -2.71%↓). Entered at a net debit of $0.61 on 8/7; exited at a net credit of $0.25 on 8/10. Loss: 59%.

$2 strike puts on Fossil Group (FOSL -14.04%↓). Entered at $0.10 on 8/9; exited at $0.10 on 8/11. Profit: 0%.

Split strike put butterfly on Beyond Meat (BYND 0.00%↑). Entered at a net debit of $2.22 on 6/13; exited at a net credit of $2.36 on 8/9. Profit: 6%.

Call spread on XPEL (XPEL 2.37%↑). Entered at a net debit of $2.25 on 8/8; exited at a net credit of $2.45 on 8/11. Profit: 9%.

Split strike put butterfly on Sonos (SONO -14.08%↓). Entered at a net debit of $2.03 on 8/9; exited at a net credit of $2.52 on 8/10. Profit: 24%.

Put spread on 23andMe (ME 0.00%↑). Entered at a net debit of $0.35 on 8/8; exited at a net credit of $0.46 on 8/10. Profit: 31%.

$3 strike puts on Fossil Group (FOSL -14.04%↓). Entered at $0.71 on 8/9; exited at $1.05 on 8/10. Profit: 48%.

Put spread on The Cheesecake Factory (CAKE -2.43%↓). Entered at a net debit of $0.62 on 8/2; exited at a net credit of $1 on 8/11. Profit: 61%.

Call spread on Alpha Metallurgical Resources (AMR 0.00%↑). Entered at a net debit of $2.45 on 6/28; exited at a net credit of $4.50 on 8/7. Profit: 84%.

Put spread on Allegiant Travel (ALGT -0.38%↓). Entered at net debit of $2.08 on 8/1; exited at a net credit of $4.23 on 8/8. Profit: 103%.

Comments

On the stock side, MTD had been drifting lower after its earnings last month, so I exited it and replaced it with one of the Portfolio Armor website’s new top names today.

On the options side, most of these exits were from earnings trades I entered this week. We’ll get to those in a moment, but first, let’s talk about the trades we entered earlier.

Exit #3 was a bet against a meme stock, Beyond Meat (BYND 0.00%↑). I got this one directionally right, but made a mistake in not exiting it sooner. With this type of options trade, it’s best to exit before the stock drops below the second strike price. My limit order to sell at 90% of the spread between the first two strikes didn’t fill, so I probably should have aimed for 85% instead there.

Exit #9 was a bet on a mining company. In hindsight, I should have made that a longer term bet with higher upside.

Exit #10 was one of last week’s earnings trades.

The rest of these exits were from earnings trades entered this week. Recall that last weekend, I mentioned a trading experiment, using Piotroski F-Scores to help select earnings trades.

My impression so far is that the Piotroski F-Score makes more sense over longer time periods. For example, the stock in Exit #4, XPEL, had an F-Score of 7, and a social data score of +65, and was basically a wash. But another stock with a similar social data score (+60) that I passed on because it had much worse F-Score (2), ThreadUp (TDUP 0.00%↑), would have been a winner this week. Over a longer time frame, out of those two, I’d be more comfortable holding XPEL.

Going forward, I plan to be more selective about earnings trades, mostly placing ones that look like they’d make sense over a time period straddling two earnings reports. That should take some of the randomness out of our returns.