Slyzyy/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

Meta Platforms (META 0.00%↑). Bought at $277.32 on 3/17; sold at $277.32 on 8/18. Profit: 0%.

Options Trades

Puts on Hilltop Holdings, Inc. (HTH 0.00%↑). Bought at $3 on 3/14; will expire worthless. Loss: 100%.

A skip-strike put butterfly on Carvana (CVNA 5.59%↑). Entered at a net debit of $1.61 on 6/14; will expire worthless. Loss: 100%.

Call spread on Green Brick Partners (GRBK 1.12%↑). Entered at a net debit of $1.88 on 7/5; will expire worthless. Loss: 100%.

Call spread on Galera Therapeutics (GRTX -3.69%↓). Entered at net debit of $0.48 on 7/24; will expire worthless. Loss: 100%.

Call spread on Alaska Airlines (ALK -1.66%↓). Entered at a net debit of $1.25 on 7/24; will expire worthless. Loss: 100%.

Call spread on Colgate-Palmolive (CL 0.76%↑). Entered at a net debit of $1.12 on 7/27; will expire worthless. Loss: 100%.

Call spread on Molson Coors (TAP 1.35%↑). Entered at a net debit of $1.05 on 7/31, will expire worthless. Loss: 100%.

Put spread on World Wrestling Entertainment (WWE 2.65%↑). Entered at a net debit of $1.98 on 8/1; will expire worthless. Loss: 100%.

Call spread on Planet Fitness (PLNT 0.91%↑). Entered at net debit of $1.05 on 8/2; will expire worthless. Loss: 100%.

Call spread on Church & Dwight (CHD 0.99%↑). Entered at a net debit of $3.90 on 7/27; will expire worthless. Loss: 100%.

Call spread on TrueCar (TRUE -2.39%↓). Entered at a net debit of $0.45 on 7/31;

will expire worthless.Loss: 100%. Fidelity exercised the long call at $2, and I sold those 700 shares at $2.13 on 8/21. Loss: 71%Put spread on Wyndham Hotels & Resorts (WH -0.27%↓). Entered at a net debit of $1.88 on 8/7; exited at a net credit of $0.88 on 8/18. Loss: 47%.

Put spread on Eastman Kodak (KODK 0.41%↑). Entered at net debit of $0.20 on 8/7; exited at a net credit of $0.16 on 8/18. Loss: 20%.

Call spread on Chegg (CHGG 9.49%↑). Entered at net debit of $0.44 on 8/7; exited at net credit of $0.48 on 8/17. Profit: 8%.

Puts on Canoo (GOEV -4.57%↓). Entered at $0.07 on 8/14; exited at $0.08 on 8/16. Profit: 14%.

Put spread on Haverty Furniture Companies (HVT -1.41%↓). Entered at a net debit of $1.48 on 8/1; exited at a net credit of $1.70 on 8/16. Profit: 15%.

Call spread on BellRing Brands (BRBR 1.97%↑). Entered at a net debit of $0.75 on 8/7; exited at a net credit of $1.50 on 8/15. Profit: 100%.

Comments

On the stock side, we had one exit for no gain. That’s our second week in a row getting stopped out of a stock position, after going a couple of months without getting stopped out of any.

On the options side, last week, 1 out of 10 of our exits were losses; this week, 13 out of 17 were.

The reason for the difference is we had a lot of trades expiring today; today’s losers represent every losing options trade from March until today that had an August 18th expiration date.

Exit #1 was a failed bet against a bank—that bank’s shares have basically stayed flat since March.

Exit #2 was failed bet against a meme stock. We’re in the money on the other two meme stocks we bet against that day, Beyond Meat (BYND 0.00%↑) and GameStop GME 0.00%↑).

Exit #3 was a failed bet on a homebuilder, after success betting on homebuilders with similar characteristics.

Exit #4 was a biotech lottery ticket that didn’t pan out. We took a flyer on another biotech lottery ticket from the same source today.

The rest of the exits above were from earnings trades, where we have been revising our process over the last several weeks.

This Week’s Earnings Trades

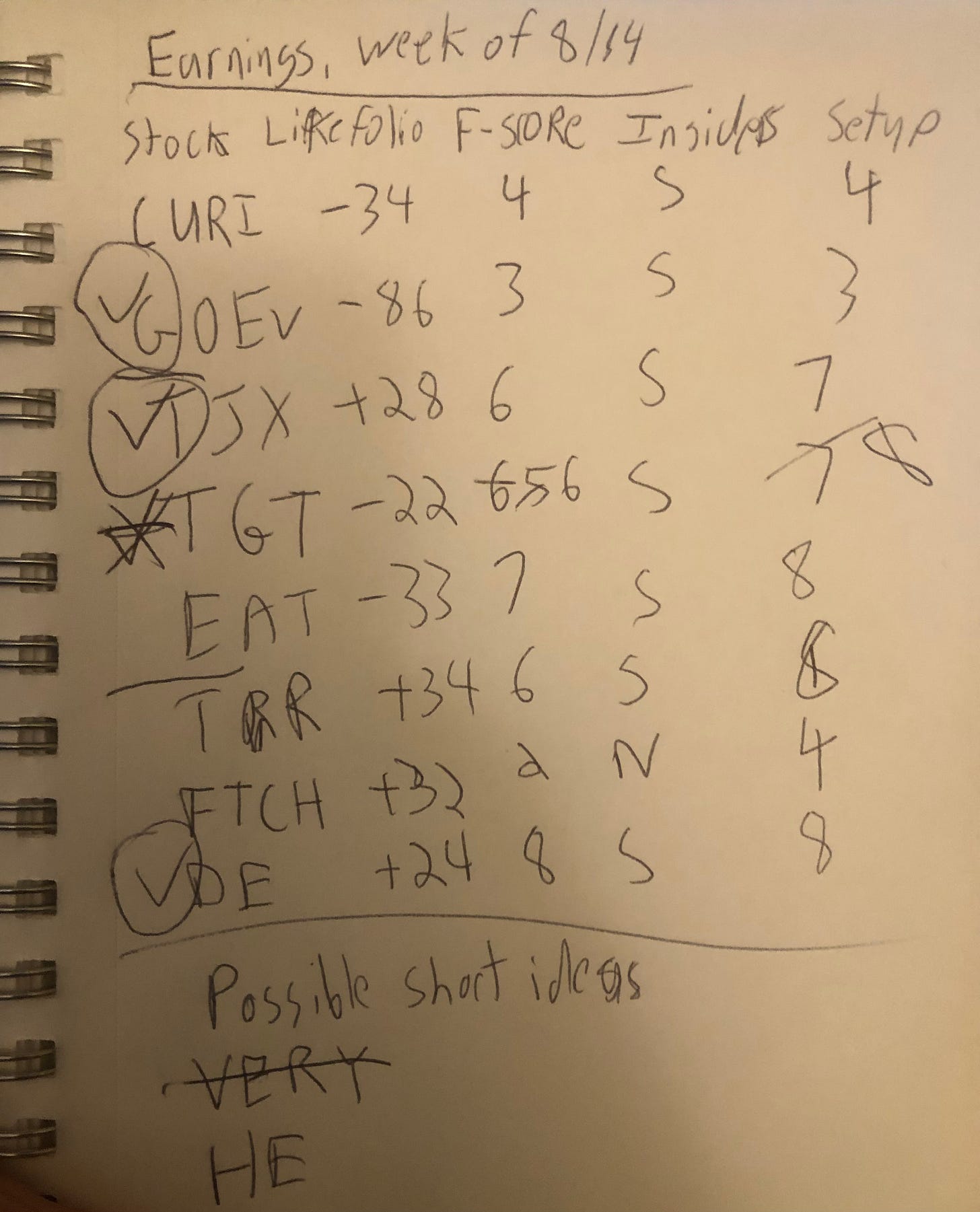

This week we entered earnings trades on the three names with checkmarks next to them in the image below.

The only one we exited this week was #15, the puts on Canoo (GOEV 0.00%↑).

Of the other two, TJX (TJX 0.00%↑) and Deere (DE 0.00%↑), both companies had earnings beats, but we’re currently only up on the TJX trade. Plenty of time left on the DE one though.

Finally, note the name above with the Piotroski F-Score of 2, Farfetch (FTCH 0.00%↑). We avoided betting on that one because of its weak F-score, despite its positive social data. FTCH plummeted 45% today, so the F-Score saved us some money there.

Well, you won a fan with your brutal honesty.

Updated the TRUE exit: looks like that one wasn't a total loss after all..